REAL TIME NEWS

Loading...

DXY Daily Trade Setup 23/1/26In this update we review the recent price action in the dollar index and identify the next high-probability trading opportunities and price objectives to target. To review today's analysis, click here!...

DXY Daily Trade Setup 23/1/26In this update we review the recent price action in the dollar index and identify the next high-probability trading oppor

Dollar Heading LowerThe US Dollar is on course to end the week lower with the DXY down around 1.255, as of writing, following a reversal from last week’s highs. The move lower comes amidst a volatile macro backdrop this week. The opening theme for the week was Trum...

Dollar Heading LowerThe US Dollar is on course to end the week lower with the DXY down around 1.255, as of writing, following a reversal from last wee

Hawkish Hold From BOJUSDJPY has seen a volatile session so far with price whipsawing around the BOJ meeting. The bank held rates unchanged, as expected, but was firmly hawkish in its outlook signalling the likelihood of further interest rate hikes to come. The bank...

Hawkish Hold From BOJUSDJPY has seen a volatile session so far with price whipsawing around the BOJ meeting. The bank held rates unchanged, as expecte

SP500 LDN TRADING UPDATE 23/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6900/6890WEEKLY RANGE RES 7047 SUP 6903FEB OPEX STRADDLE 6726/7154MAR QOPEX STRADDLE 6466/7203DEC 2026 OPEX ...

SP500 LDN TRADING UPDATE 23/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA

VWAP Swing Strategy Trading Update 23/1/26In this video, we review last night's VWAP Swing Strategy scanner alerts, setups, and trades. For access to the strategy and scanner, email [email protected] for access details.https://www.tradingvi...

VWAP Swing Strategy Trading Update 23/1/26In this video, we review last night's VWAP Swing Strategy scanner alerts, setups, and trades. For acces

USD: Better US data produced “interesting” USD price action, but it reinforces her medium-term weaker USD view because growth upgrades and decent data still aren’t translating into sustained USD support.- USD structural theme: The investment/hedging narrative is bu...

USD: Better US data produced “interesting” USD price action, but it reinforces her medium-term weaker USD view because growth upgrades and decent data

The FX options market had a turbulent week, with the unexpected Trump-Greenland saga causing early spikes in implied volatility. Markets were shaken, and demand for options surged on Tuesday. However, as Trump walked back his comments during Davos, volatility eased...

The FX options market had a turbulent week, with the unexpected Trump-Greenland saga causing early spikes in implied volatility. Markets were shaken,

Daily Market Outlook, January 23, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Asian markets advanced, while the dollar continued to struggle as investors turned their attention to non-US assets amidst policy uncertainties ...

Daily Market Outlook, January 23, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Asian markets advanced, while

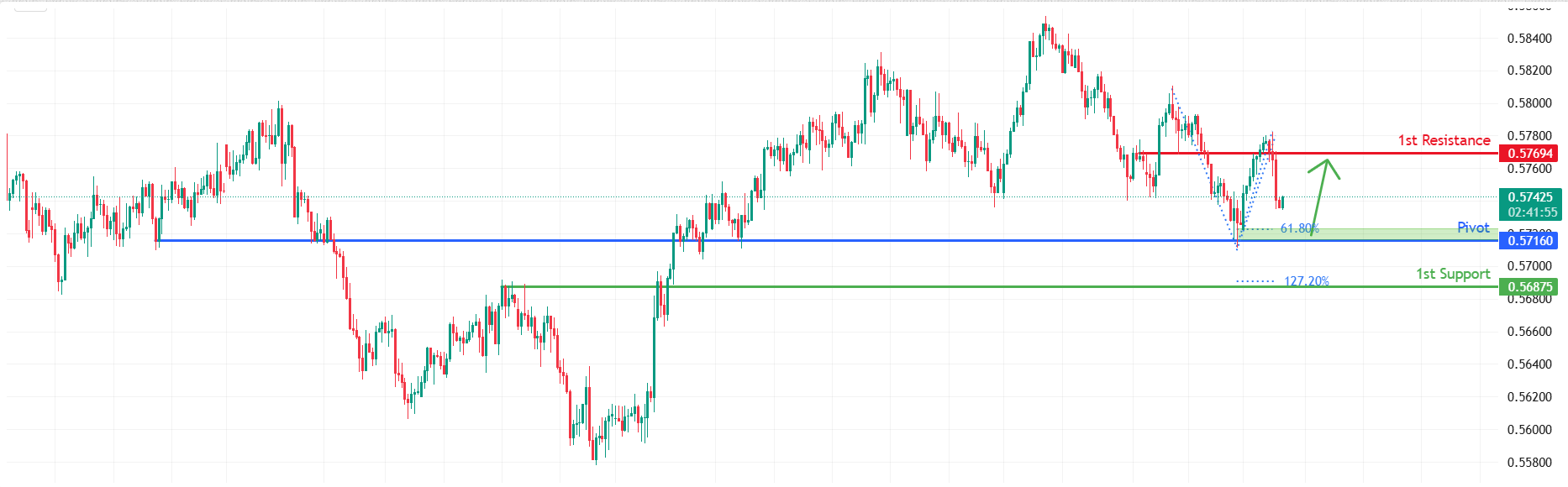

Strong Aussie DataDespite the geopolitical risks which dogged the first half of the week, and still linger in the background, AUD has gone on to be the strongest FX performer against the Dollar. Alongside NZD, AUD has risen firmly this week, capitalising on a softe...

Strong Aussie DataDespite the geopolitical risks which dogged the first half of the week, and still linger in the background, AUD has gone on to be th

Title CHFJPY H4 | Falling toward 61.8% Fib supportType Bullish bounce Preference The price is falling towards the pivot at 197.97, a pullback support that aligns with the 61.8% Fibonacci retracement. A bounce at this level could lead the price toward the 1st resist...

Title CHFJPY H4 | Falling toward 61.8% Fib supportType Bullish bounce Preference The price is falling towards the pivot at 197.97, a pullback support