Copper Bulls Return

Copper Turning Higher Again

Copper prices are turning higher again today following a week of heavy congestion. The futures market has been trapped in a narrow band of trading following the reversal lower on Friday Oct 10th as Trump threatened to hit China with fresh 100% tariffs. The move higher has been partly linked to an easing of US/China trade tensions since that date. A softer tone from Trump, as well as the scheduling of US/China negotiations this week has fuelled optimism that a deal can be agreed ahead of the upcoming Nov 10th deadline.

US/China Trade Talks

Delegates from the two countries are due to meet in Malaysia tomorrow to resume trade talks ahead of a potential meeting between Trump and Xi at the APEC summit next week in Korea. If talks this week go well and we see positive headlines emerging, this should push copper prices furtehr higher near-term, bolstering risk appetite generally.

Supply Disruptions

Prices are also rising on the back of news of yet further supply disruption in the copper industry. The partial collapse of a mine in the Dominican Republic has seen reduced supply coming from there, adding to supply disruptions amidst the ongoing suspension of production at the Grasberg mine in Indonesia and the El Teniente mine in Chile. While supply from these mines remain down, upside pressure on price should remain.

Technical Views

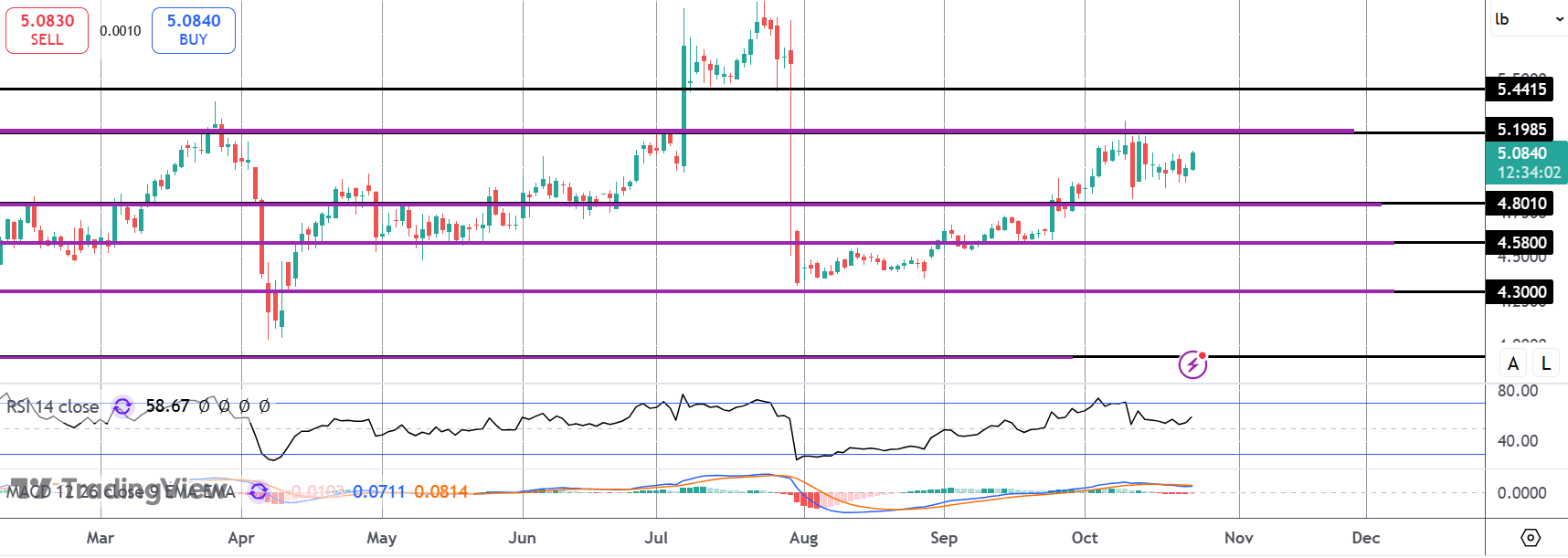

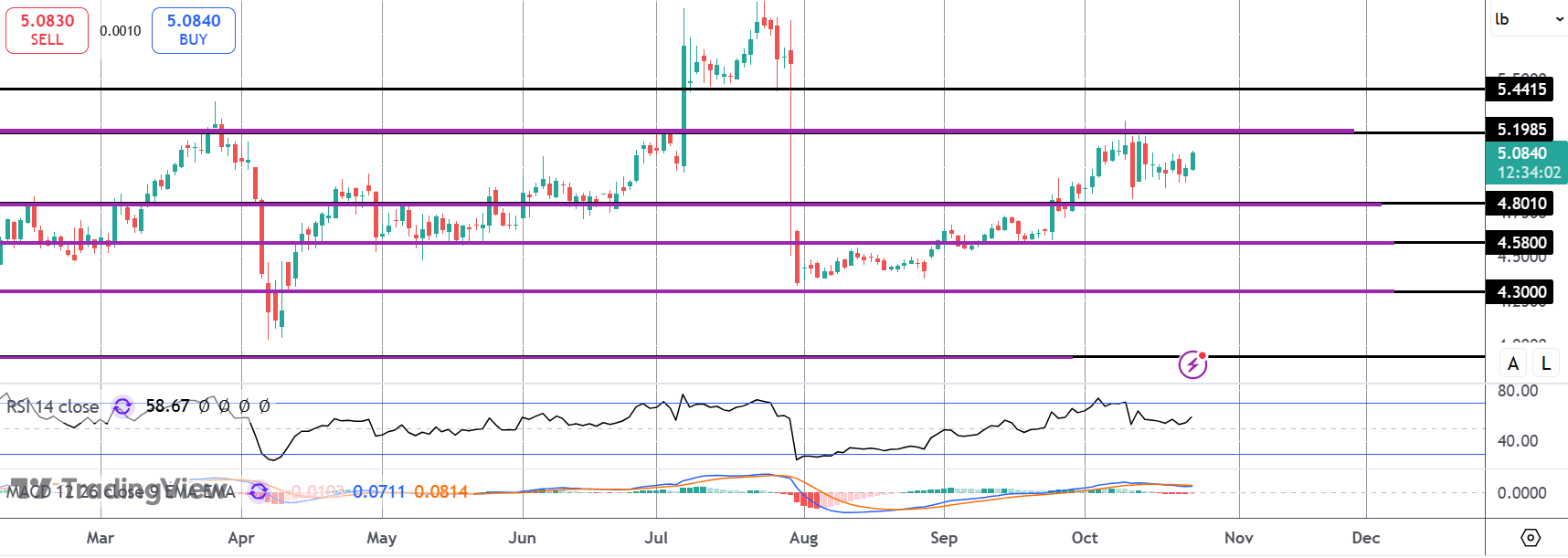

Copper

The correction lower in copper found support into the 4.8010 level. While that level holds, focus is on a fresh test of the 5.1985 and a breakout towards the 5.4415 level next with the YTD highs sitting above as the main objective for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.