Crude Bouncing Midweek - What to Watch

Crude Recovery Underway?

Crude prices are attempting to recover midweek with the futures market bouncing of the latest test of the YTD lows. The move looks to be driven by several factors including, some optimism over US/China trade talks, US strategic reserve buying and rising hopes that India will agree to cut Russian oil imports. Crude futures are currently up more than 4% off the week’s lows and look poised to continue higher through the end of the week unless we get any negative news shocks.

US/China Trade Talks

On the US China front. The return of hostile rhetoric and trade treats between the two sides over recent weeks had seen crude prices plunging lower as traders feared a return to all out trade war. However, a softer tone from Trump in recent days as well as news that US and Chinese leaders will meet this week, has helped bolster optimism. While there is still uncertainty over whether Trump and Xi will meet, for now there is better sentiment that a deal (or at least an extension to current terms) can be agreed ahead of the Nov 10th deadline. Any positive headlines this week on the back of US/China talks should help lift crude further here.

US Strategic Buying & India News

Crude prices are also being lifted this week by news that the US energy department is planning to bolster its strategic reserves. The government plans to purchases crude for delivery in December in January to help reserve levels of their current 60% mark. Expectations that the US will buy around 3 million barrels is feeding into firmer prices here. Additionally, news that India is reportedly moving closer to agreeing to limit its Russia crude imports in exchange for lower tariffs on exports to the US is also helping bolster oil prices. Any concrete news on this front should lift prices higher near-term.

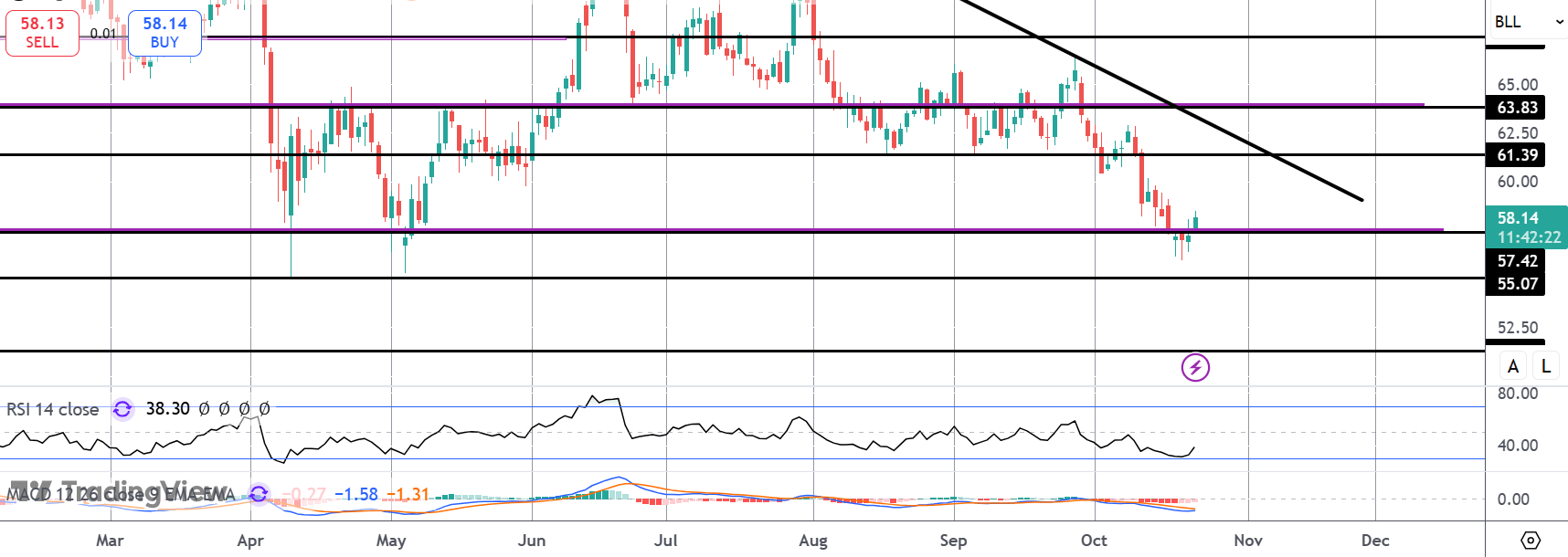

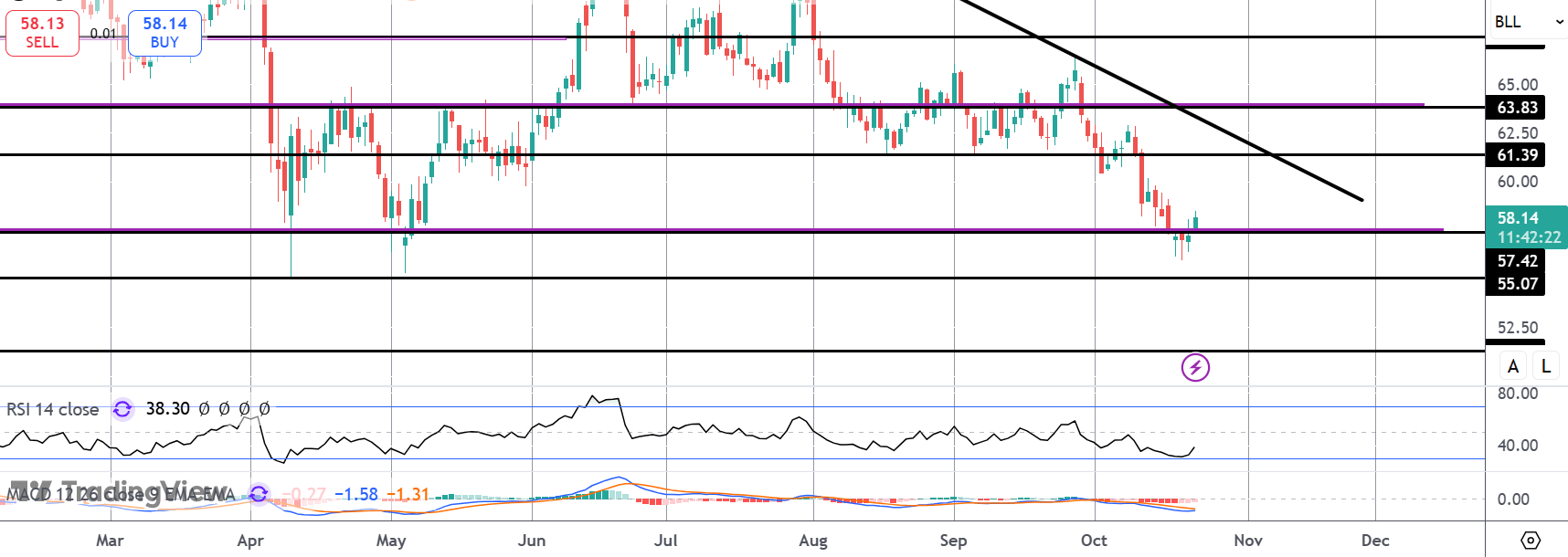

Technical Views

Crude

The sell off has stalled for now into a fresh test of the big support level 57.41, just ahead of the YTD lows. With this level holding and momentum studies bouncing, a recovery could be on the cards. The 61.39 level and bear trend line will be the first hurdle for bulls with 63.82 the higher level to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.