Dollar Ending Week Higher After Hawkish Fed Twist

Hawkish Fed Outlook Shift

The US Dollar is on course to end the week firmly higher with the DXY remaining well-bid on the back of the shift in view from the Fed midweek. Despite cutting rates by a further .25% as expected, the Fed struck a decidedly less-dovish tone with Fed Powell warning over division among policymakers and a lack of conviction over further easing this year. With uncertainty growing over the lack of labour market data available to policymakers during the ongoing US govt shutdown, Powell warned that a furtehr cut in December (as per the recent dot plot forecasts) was not a foregone conclusion. On the back of those comments, pricing for a December cut has dropped from around 95% pre-FOMC to around 66% currently.

Trump & Xi Agree Deal

Alongside the shift in Fed expectations, USD is also deriving support from news of a fresh trade agreement between the US and China this week. Following preliminary talks between US and Chinese officials over the weekend, Trump and Xi signed off on a deal which includes a 12-month extension of tariff pauses, US access to rare earths as well as increased Chinese purchases of US soybeans. Markets are hopeful the meeting and deal will mark the start of better relations between Trump and Xi, feeding into better US economic prospects.

Technical Views

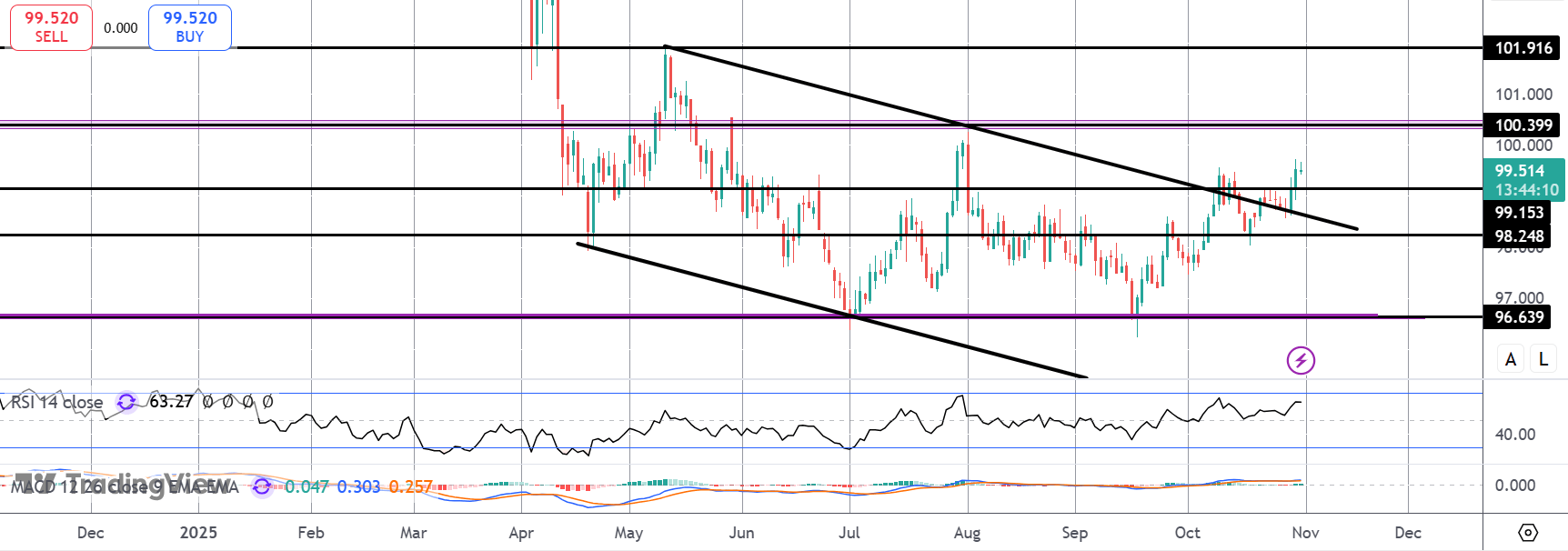

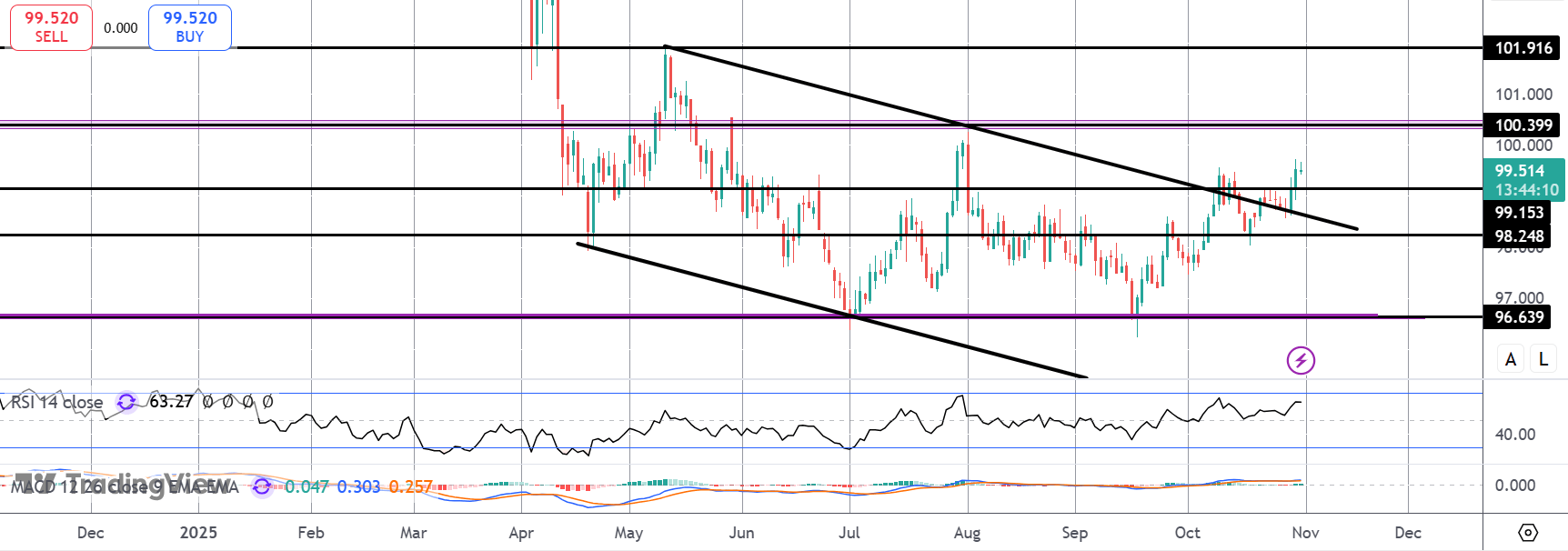

DXY

The rally this week has seen the index breaking out above the 99.15 level with the channel break now starting to build fresh momentum. If price can stay above 99.15, 100.38 will be the next resistance to watch with the 101.91 level above the higher target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.