SP500 LDN TRADING UPDATE 10/11/25

.jpg)

SP500 LDN TRADING UPDATE 10/11/25

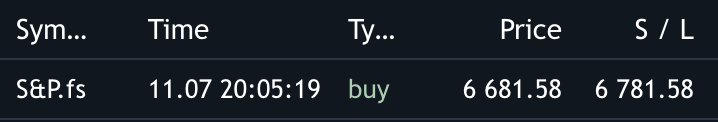

***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE***

***WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***

WEEKLY BULL BEAR ZONE 6820/30

WEEKLY RANGE RES 6877/6629

NOV EOM STRADDLE 7054/6626

NOV MOPEX STRADDLE 6929/6399

DEC QOPEX STRADDLE 7054/6303

Gamma is somewhat low, but there is adequate hedging established at this point. If there is no continued selling at the start of next week, it could instil some confidence that our higher low on the daily chart is established. Just a reminder, in a situation where there is a long gamma and the previous quarter leads the previous month, the market often stabilises. Dealers buy on downturns and sell on upswings, and volatility control funds have limited actions to take.

DAILY VWAP BEARISH 6794

WEEKLY VWAP BULLISH 6744

DAILY STRUCTURE – ONE TIME FRAMING LOWER - 6755

WEEKLY STRUCTURE – BALANCE - 6952/6655

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6591

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

One-Time Framing Down (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

GOLDMAN SACHS TRADING DESK VIEWS

weekend prep ...

9 November 2025

person Brian Garrett

Goldman Sachs & Co. LLC

thirteen full sessions until thanksgiving, thirty full sessions until christmas … time for some prep… three widgets for the week, more to come this market and the daily swings are not what many would consider healthy – doesn’t mean the market needs to materially sell off, it just means the anxiety around intrasession 40 handles is extremely high …

based on the quantum of questions, one would think the VIX was low 30s and that SPX was down on the year vs VIX in high teens and SPX +14.5% ytd

1/ pb (defensive rotation) … gross exposure is coming in (its no longer eye-popping off the page) but still in the 98th pctl on a 5y lookback … while investors are choosing to stay long, they are rotating into defensive pockets (selling TMT + Discretionary vs buying Healthcare + Utilities + Staples) … not what you’d expect with SPX 2.5% off the all time high

2/ one-delta (long only supply) … cash desk highlights that the long only community has been a net seller for four weeks in a row … total supply from this cohort is $8bn on the one month lookback (not insignificant)

3/ systematics (mind the thresholds) … that escalated quickly ... spx broke the short term threshold on Friday (~6700 cash) only to rally back into the bell… the CTA community has been on the sidelines for months, but expect the volume to increase significantly in the coming sessions (i'm 20 bid for the client pdf request count)… chart i / SPX + NDX + RTY are on top of their short term thresholds (avg) … chart ii / the amount of SPX length relative to VIX spot (high)

4/ derivs (spot vs vol) … spx had two 100bps+ sell offs this week, would have been three if not for a 140bps rally Friday afternoon … the daily bands are getting wider … chart below, investors are no longer dealing with a market that solely “crashes up” (this has repercussions for put and call skew)

5/ derivs (earnings) … earnings season has proven two things … 1/ when the spx is at the highs and valuations feel full – the bar for an EPS beat to outperform is extremely high – EPS beats are not being rewarded this quarter / not all sectors are created equal when it comes to implied / realized statistics – energy vol has offered significant value

6/ econ (wow) ... univ of michigan data came out Friday … consumer sentiment is at the second lowest level of all time and the survey of economic conditions registered the lowest level of all time … reminder the united states has had 11 recessions since 1950 and yet sentiment on economic conditions has never been worse

- good luck

source: gs global banking and markets / ficc and equities / as of 9nov25 / past performance not indicative future returns

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!