SP500 LDN TRADING UPDATE 27/1/26

SP500 LDN TRADING UPDATE 27/1/26

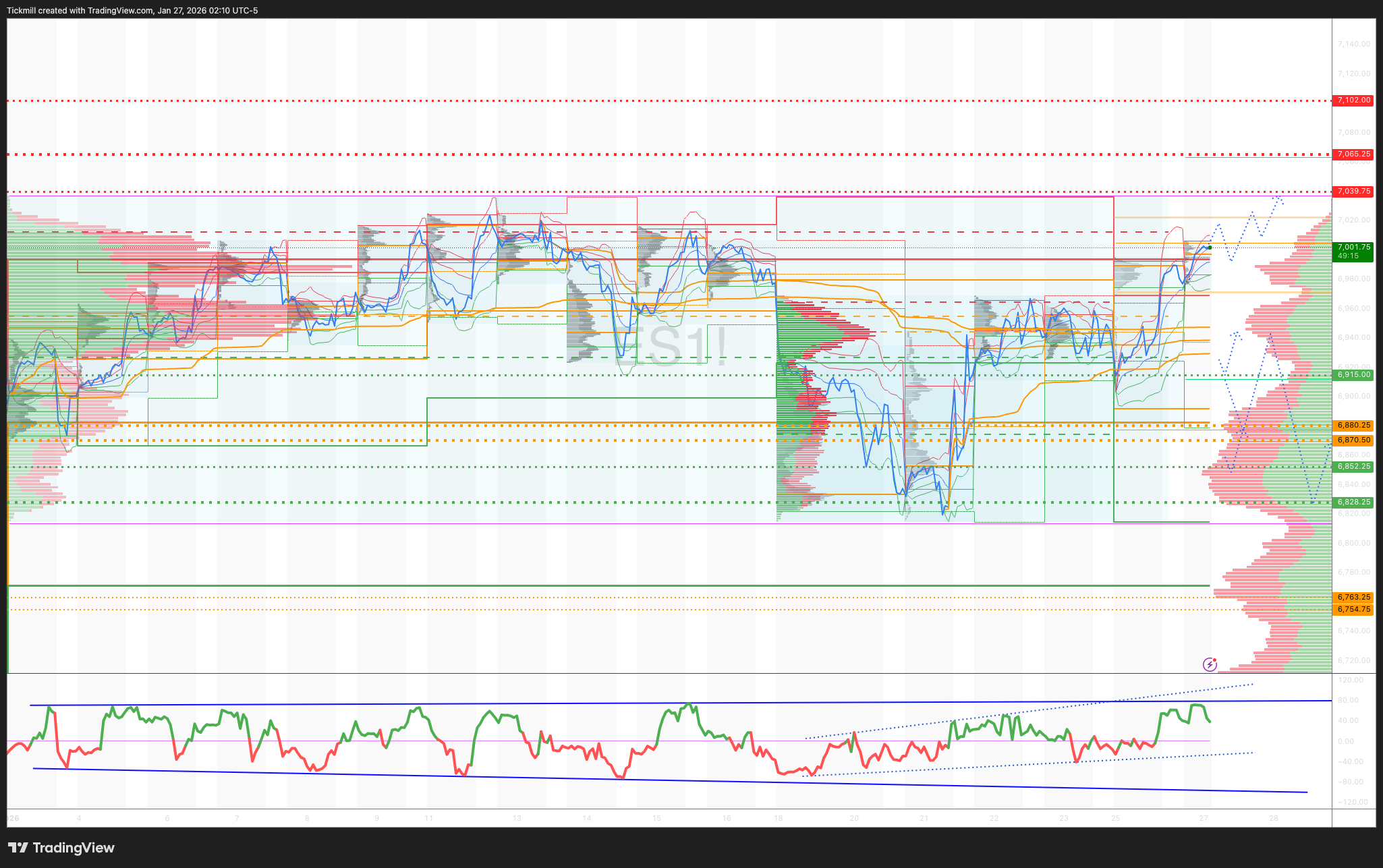

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6880/70

WEEKLY RANGE RES 7065 SUP 6928

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

The Gamma Flip Zone at 6972.75 is crucial; above it, the market experiences “Positive Gamma” with reduced volatility and easier upward movement. Below it, “Negative Gamma” results in erratic price action. Bulls must reclaim this level to stabilise the market.

DAILY VWAP BULLISH 6896

WEEKLY VWAP BEARISH 6961

MONTHLY VWAP BULLISH 6856

DAILY STRUCTURE – BALANCE - 6925/6969

WEEKLY STRUCTURE – ONE TIME FRAMING LOWER - 6969

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

DAILY BULL BEAR ZONE 6988/78

DAILY RANGE RES 7039 SUP 6890

2 SIGMA RES 7102 SUP 6852

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.42

TRADES & TARGETS

PRIMARY PLAY - LONG ON REJECT/RECLAIM DAILY BEAR ZONE TARGET 7022 > DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “DISPERSION”

S&P rose 50bps, closing at 6,950, with a MOC of $4.5bn to SELL. NDX gained 42bps to finish at 25,713, while R2K dropped 36bps to 2,659. The Dow climbed 64bps, ending at 49,412. A total of 18.4 billion shares were traded across all US equity exchanges, matching the YTD daily average. The VIX increased 37bps to 16.15, WTI Crude fell 72bps to $60.63, the US 10YR yield declined 1bp to 4.21%, gold surged 210bps to 5,122, the DXY dropped 55bps to 97.06, and Bitcoin dipped 5bps to $87,931.

US equities showed resilience, brushing off negative weekend developments, including Yen strength/USD weakness, Trump’s 100% tariff threat on Canada, and heightened risk of another government shutdown by week’s end. Precious metals GLD and SLV continued to hit all-time highs. The R2K’s 14-session outperformance streak ended Friday and extended lower today. Client activity was subdued as the market gears up for a busy week, with 33% of S&P market cap reporting earnings (META and MSFT on Wednesday, AAPL on Thursday), alongside FOMC and PPI data.

Software stocks exhibited notable strength, with IGV up for a third consecutive session. This created tension among hedge funds following CRWV’s 6% gain (down from +13%) after NVDA’s $2bn investment, accompanied by sharp gains in NET (+12%) and DOCN (+10%). The squeeze risk in software remains significant. The long semis vs. short software trade represents the largest dislocation in the US equity market currently. Software net exposure, as a percentage of total US Prime book, peaked at 17.7% in mid-2023 but has since dropped to 4.7%, the lowest on record. Meanwhile, net exposure in Semis & Semi Equipment has risen from 2.2% to 8%, the highest on record. The Software vs. Semis pair (GSPUSOSE) is down 18% YTD, with earnings likely serving as the next major catalyst.

Activity levels on our floor were rated a 4 on a 1-10 scale. The floor ended +312bps to buy, compared to a 30-day average of -95bps. Long-only funds were net buyers by $2.5bn, driven by macro trends and select industrials, financials, and healthcare names, while hedge funds were slight net sellers at -$700m. For the Month-End Pension Rebalance, we estimate $4bn in US equities for sale. Buyback activity has begun to pick up, as we are now officially in the estimated open window period, which typically starts 1-2 days post-earnings.

After-hours activity saw declines in HUM (-15%), UNH (-11%), CVS (-9%), and ALHC (-13%) following news that the Trump Administration proposed keeping steady rates for Medicare payments to insurers (WSJ). Hedge fund long supply remains a key focus in the post-market environment.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!